Ownership of Rural Land can result in significant Ad Valorem Tax relief.

VALUATION:

An exemption doesn’t result in no ad valorem taxes being paid. It means that the land under exemption (based on its use) is appraised differently than other properties. This generally results in a much lower valuation and, accordingly, lower taxes. The land is exempt, not improvements. Check on Homestead Exemptions for possible tax savings.

In Texas, property assessments are based on market value. For land to have an exemption, an agriculture productivity appraisal (1-d-1) is used. This valuation reflects the capitalized rental cost of the land-based on agricultural use, recreational use, or hunting. Profit and loss on the actual business operation are not used because of business components (going concern) in addition to the land. Click on the link below for more information.

Agricultural, timberland, and wildlife management use a particular appraisal.

OBTAINING AN AGRICULTURE EXEMPTION:

Article VIII, Section 1-d-1, Texas Constitution, and Chapter 23, Subchapter D, Texas Property Tax Code, provides for appraisal of open-space land.

An application for 1-d-1 (Open Space) Agricultural Use Appraisal (click here) must be sent to the Appraisal District’s Chief Appraiser in which the property is located.

To qualify for an agriculture exemption, the land must have been used or leased for agriculture five of the past seven years. The appraisal district will establish a minimum size (acreage) policy. This use must have been to the degree of intensity generally accepted in the area in which it is located. The agriculture exemption runs with the land, not the individual.

WILDLIFE EXEMPTION:

A Texas landowner who wishes to obtain a wildlife exemption must currently be approved for an agricultural property tax exemption. Next, you must fill out the appropriate form and provide it to the appraisal district in which the property is located. For more information, click on the following link.

Wildlife Management plan for agricultural tax valuation (PWD-885).

When the property has qualified for a wildlife exemption, the owner will follow a plan with activities that benefit the target species of the area in which they are located. The Texas Parks and Wildlife Department does not administer this program. The County Appraisal District administers the program. They establish a policy regarding minimum size (acreage) and will conduct inspections periodically. They will notify the owner in advance. Certain agricultural operations can be performed concurrently with a wildlife exemption. The owner can return to an agriculture exemption whenever they wish but need to inform the Appraisal District.

At least three of seven wildlife management practices must be used.

The seven practices are as follows;

1. Habitat Control

2. Erosion control

3. Predator control

4. Providing supplemental water supplies

5. Providing supplemental food supplies

6. Providing shelters

7. Making census counts determine population

You may want to contact one of the numerous consultants. They specialize in creating wildlife management plans and working with your appraisal district to implement them. Annual wildlife management plans must be filed with Chief Appraiser. The consultant will prepare these as part of their services.

Click on Guidelines for Qualification of Agricultural Land in Wildlife Management.

There are many reasons for choosing a Wildlife exemption over Agriculture;

1. Cost savings; Feed, Vet bills, Repairs, Equipment maintenance, etc.

2. Decreased workload.

3. Decreased liability.

4. The attractiveness of property surroundings compared to agriculture.

5. Wildlife use may be more compatible with the floodplain.

6. New owners in rural areas may not be interested in agriculture.

7. A weekend retreat may fit with wildlife surroundings better than agriculture.

I believe, personally and professionally, that an increasing number of people from the urban area will buy rural properties with wildlife exemptions over agriculture exemptions for recreational and residential purposes.

Additional resource links are as follows;

TPWD Wildlife Management Valuation FAQ

TPWD Wildlife Management Valuation Legal Survey

ROLLBACK TAXES:

A rollback tax is a penalty paid for the change in use from exempted property to non-exempt use. The amount of tax is the difference between the taxes paid based on the exemption and the taxes that would have been paid without the exemption over the last three years with an annual 5% interest charge.

A very simplified example is as follows:

A 100-acre tract exempt valuation is $500 per acre. The assessment rate is 2% in the County Appraisal District in which the property is located. The annual ad valorem taxes would be $1,000 (100 acres X $500/acre X .02). The property sells, and the new owner develops the tract into 2-acre homesites. Comparable sales of large acreage tracts suitable for residential development indicates a market value of $3,000 per acre. The annual ad valorem this type of property would be $6,000 (100 acres X $3,000/acre @ .02). The difference in annual ad valorem taxes would be $5,000 ($6,000 minus $1,000). The rollback tax would be $18,750 ($5,000 X 3 years X 1.15). The buyer/developer would be liable for the rollback tax.

NOTE: The retail value of individual lots would not be used.

When land, with an agriculture exemption, changes to non-agricultural use, the property owner responsible for changing the usage will pay the rollback tax.

Exemptions to Rollback taxes include the following;

1. Sale for Right of Way

2. Condemnation

3. Transfer to the government or non-profit entity for a public purpose.

4. Transfer from government or non-profit for a public purpose

5. Timberland

6. Cemeteries

7. Religious Use

8. Charity

9. Schools

10. Oil & Gas

CONCLUSIONS:

The County Appraisal District administers the various exemption programs. The application requires sending paperwork to the Appraisal District. The property must have been in agricultural production for five of the preceding seven years before application.

Wildlife exemptions can only be approved on a property that already has an agriculture exemption. Each Appraisal District has guidelines for minimum size (acreage) requirements. A wildlife exemption involves a management plan which must be updated annually.

Rollback taxes are assessed when the use of land with an exemption is changed to non-exempt use. Any change in property use could have tax consequences.

You should contact a tax professional regarding the impact of changing your property use. This post is for informational purposes only and does not represent legal advice in any way.

CHECK IN WITH US

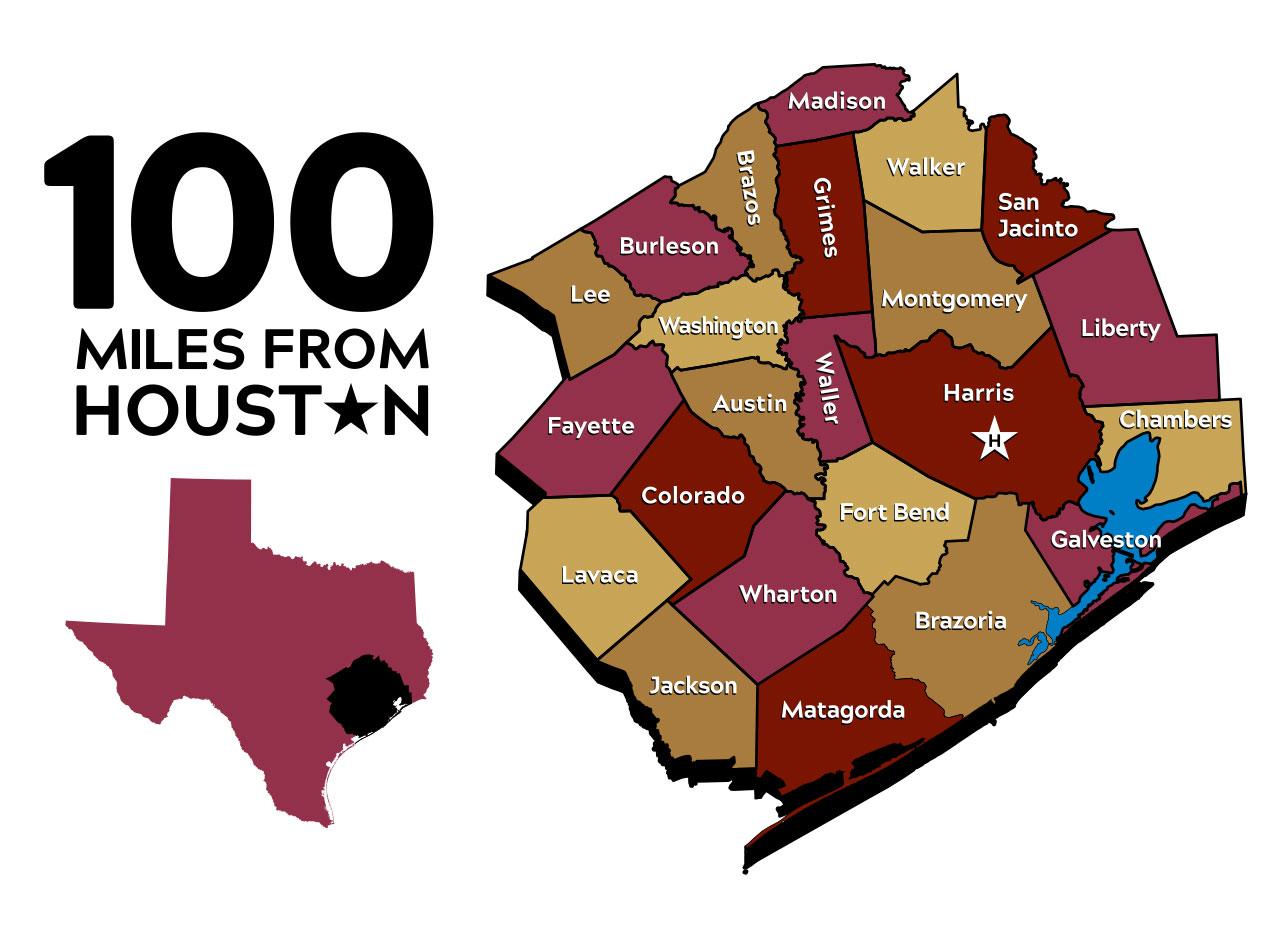

Allen Realty Advisors represents buyers and sellers of fine quality rural land near Houston. We specialize in weekend retreats, country estates, farms and ranches, recreational property and investment land. Our market area is generally within 100 miles (two hours) of Houston.

We are members of the RLI

We support the 4H and FFA

You might enjoy some of the following blog posts:

Easements Across Rural Land Near Houston

Texas History and Land Intertwined: 20 Books

Impact of Rights of Way Across Rural Land Near Houston

Choosing a Land Broker For Rural Land Near Houston

What is a Land Survey and When Do You Need One?

15 Common Questions About The Hemp Industry

Future Farmers of America: Pathway To Success

50 Great Time Saving Resources For Rural Land Near Houston

Country Fairs within 100 Miles of Houston

Country Lifestyles within 100 Miles of Houston

20 Questions (At Least) You Should Answer Before Buying (Or Selling) Rural Land Near Houston

Why Your Texas Broker Should Be A Member of the Realtors Land Institute

Financing Rural Land Near Houston

Why You Need a Buyers Representative When Buying Rural Land Near Houston

Road Trips within 100 Miles of Houston

Great Barbecue Joints within 100 Miles of Houston

100 Miles From Houston: Rural Land Near Houston

From Contract to Closing

Appraising Rural Land Near Houston

Checklist for Selling Rural Land Near Houston

Checklist for Buying Rural Land Near Houston

Things to Consider Before Buying Rural Land Near Houston

THANKS FOR SHARING OUR POSTS