Value is fundamental to making a real estate decision. An opinion of value is necessary before almost any action with regard to land can be made. Just a few examples include; buying, selling, taxes, litigation, probate, easements and the list goes on. There are many types of value and they all have their place in the decision making process. This post is about market value appraisals and how they fit into the mix.

What is Rural Land Near Houston Worth?

What is land worth constitutes a pretty broad question but I get asked that almost everyday. First of all let’s talk about the two types of value; what is it worth to me and what is it worth in the market place.

What is it worth to me? The technical term used by appraisers is value in use. Value in use is value peculiar to an individual or entity in contrast to the market place at large. Let’s consider a couple of examples. A property that has been in the family for generations has a legacy value to its owners but not necessarily to buyers in the market place. Alternatively, a farmer or rancher looking for land to use for production agriculture probably is not willing to pay the price of rural land influenced by being relatively close to an urban area such as Houston.

What is land worth in the market place? The most straight forward definition of market value is the most probable sales price. Market value is measured with comparable sales assuming highest and best use. We will talk about comparable sales, highest and best use and a few other terms a little later in the post. Market value is usually reported in a formal written appraisal report.

What is an appraisal?

An appraisal is an estimate of value of a particular property as of a certain date. It is based on data such as comparable sales similar to the subject property and its highest and best use. The appraisal opinion and supporting data are usually conveyed in a written report signed and certified by a state certified appraiser.

What is not an appraisal?

Often there is confusion as to what constitutes an appraisal. A brokers opinion of value, comparable sales analysis, ad valorem tax assessments and surveys are not appraisals. One of the primary differences is who prepares the report. The brokers opinion of value (also sometimes called comparable sales analysis) is prepared by a state licensed real estate broker. The opinion of value prepared by a knowledgeable real estate broker is probably quite accurate (after all they know their market) but has not been prepared by a certified real estate appraiser. An ad valorem tax assessment is not an appraisal however the underlying analysis is much the same. A survey is not an opinion of value at all but rather a description of the physical property and is prepared by a registered surveyor.

Who prepares an appraisal?

Most states require appraisal licensure for all valuation work performed. In Texas the Texas Appraiser Licensing and Certification Board (TALBC) regulates appraisers. An appraiser will be certified either for residential appraisals (1 to 4 units) only or for non residential (land and commercial) appraisals. A general certified appraiser can perform appraisals of all types of property.

Certification requires a rigorous program of education, experience and a comprehensive examination. Prior to becoming a certified appraiser an individual will be a trainee and apprentice under the supervision of a certified appraiser. State certified appraisers are subject to renewal each two years based primarily on educational requirements.

Appraisal Designations

In addition to state certification there are private designations offered by various professional appraisal organizations. These designations involve additional requirements above and beyond the requirements for state certification. Some of the oldest and best know appraisal organizations include;

• Appraisal Institute (AI). AI designations include; MAI for commercial properties, SRA for residential and AI-RRS for reviews. The Appraisal Institute is the largest appraisal organization in the nation.

• American Society of Appraisers. The ARA is a multi disciplinary appraisal organization including; business valuation, personal property, equipment and real property. Their real property designation is RP.

• The American Society of Farm Managers and Rural Appraisers. The ASFMRA specializes in agriculture related properties. They award the Accredited Rural Appraiser (ARA) and the Real Property Review Appraiser (RPRA). The ASFMRA is the oldest appraisal organization in the United States and their designations are highly regarded in the rural property arena.

Appraisal Specialization

Some appraisers specialize by property type such as rural land, shopping centers or office buildings. Others specialize by function such as litigation or review. An appraiser who specializes almost always will obtain a designation from one or more of the above professional valuation organizations. I have known appraisers who specialize in litigation valuation who have law degrees.

Appraisal as a career.

It is my personal (and professional) opinion that an appraisal background is a real asset for a career in real estate. My advice to a young person right out of college who is interested in a career in real estate would be to join an appraisal firm (preferably in rural properties) to begin with. In Texas an individual with a college degree can earn their general certification in between two to three years. This background would enable them to enter any area of real estate to include; banking, development, brokerage, management, investments , etc.

When is an appraisal required?

I use the word required above for a reason. Don’t get an appraisal unless it is required. They are expensive and time consuming. That is my professional opinion and I have been an appraiser (MAI) almost all of my adult life. However, if you deal with real estate, the time for an appraisal will almost certainly arise. Interestingly, a third party will almost always order the appraisal. Of course you will pay for it. There are three situations which generally will require an appraisal; financing, litigation and probate.

• Financing. Any lender will require an appraisal during the mortgage loan process in order to ascertain the value of the asset for collateral purposes. Federal and state law requires the appraisal be performed by a certified appraiser according to the Uniform Standards of Professional Appraisal Standards (USPAP). Each certified appraiser must take a USPAP course every two years.

• Litigation. Lawsuits can arise for an infinite number of reasons but the appraisers role is much the same in each case. They will appraise the property involved in the matter, prepare a report and be prepared to testify as to their conclusions. The attorney in charge of the case will usually engage an appraiser who is experienced in litigation valuation and expert witness testimony. For purposes of this post we will focus on eminent domain litigation.

• Probate. An individuals estate will often have a considerable real estate component. An appraisal is necessary to assist the executor to administer and distribute the property. Some of the uses for the appraisal are to figure out whether the estate will have to pay estate taxes and also to assist in fairly dividing assets according to the will or state law.

Some appraisal terminology.

A brief review of some appraisal terms might serve to help develop the key concepts underlying using value as an analytical tool for decision making.

• Market Value. Sometimes referred to as value in exchange. Sometimes referred to as the Comparable Sales Approach. As noted earlier, the simplest definition is the most probable sales price. It is not the value to a particular individual or entity but rather to a large group of people. Market value assumes the property is being used at its highest and best use whether it is or isn’t. Appraisals are generally based on Market Value. Market Value is used for litigation, financing and probate.

• Highest and Best Use. The term assumes; legally permissible, physically possible, financially feasible and the most profitable use. It is generally associated with the underlying land value regardless of current use.

• Use Value. This term is also referred to as Value in Use and Investment Value. This concept refers to a particular individual or entity specific (often current) use. It can be measured by the net present value of cash flows for a specific owner under a specific use. Sometimes going concern is reflected in use value. Use value is not appropriate for litigation, asset financing or probate.

• Comparable Sales. Actual transactions are a much better indicator of value than listings. Comparable sales are the foundation of the Market Approach. Particular care must be given to starting with a comparable property which is truly similar to the subject property. Hopefully the confirmation will be an in depth interview with one of the parties to the transaction. Accurate adjustments need to be made for the differences between the properties.

• Income Approach. This is one of the classical three approaches to value along with the Cost and Market Approaches. It is usually applied to income producing improved properties rather than rural properties. In some cases the income approach is useful appraising when the highest and best use is production agriculture. Usually eases are the sources of income to be capitalized rather than actual crop or livestock yields.

• Cost Approach. The basic formula is land plus contributory value of the improvements. The land is appraised via the market approach with comparable sales. The improvements are estimated by using cost new less depreciation. Depreciation is very difficult to estimate especially with respect to rural improvements. Accordingly, the cost approach is seldom used for rural property valuation. Sometimes cost new figures for some items (ponds, fencing, sheds and so on) can be useful for adjustment purposes.

• Market Approach. This is the approach most often used in connection with rural property. As discussed above, it relies on comparable sales of similar properties and assumes highest and best use. Improved sales can be used if the subject has significant improvements.

What factors impact market value?

In the final analysis people impact market value. I am referring to an aggregation of people not necessarily to individuals. Measuring the impact of a specific factor is based upon analysis of comparable sales data. The more sales available the better the estimate will be. In some cases cost will give us an idea of the impact of the factor. Any analysis of a particular factor assumes all other factors being equal. Keep in mind however that all factors are relative to other properties in the area.

• Location. Location can refer to the general area or to a specific neighborhood. It can be measured in terms of distance from the nearest town or from a major metro area. It also can be narrowed down to a particular road. How long does it take to drive to major grocery store? How much time to get to a medical facility? How is the immediate vicinity characterized. Are any undesirable structures nearby. The general area defines the area from which comparable sales are derived. What kind of ownership abuts the subject property? Ideally, the adjoining properties ares large vacant tracts owned by a long standing family who is unlikely to sell in the near future. Not so ideally would be small lots with substandard housing. What are the trends in the neighborhood? Are new homes being built on large acreages. In which school district is the subject located? How does it compare to other school districts in the area?

• Size. Basically, the larger the size of the land, the less the value per unit. For example, all things being equal, a 100 acre tract will sell for less per acre than a 10 acre. Why? Even though the price per acre will be less, the overall price is more. There are fewer buyers who are able to afford the larger tracts. There are many buyers who can afford the smaller tract. Consider the possibilities of the larger property in terms of development.

• Access. How do you get to the subject? Paved road or all weather road. Does the property have frontage or is it accessed via a lane? Is the lane a fee strip or an easement? Is the property land locked? Are you able to get a driveway?

• Topography. Is it flat or rolling? Is it in a floodplain? Is there erosion? Is there a building site? Is it wooded or all field? Is there a site for a pond?

• Utilities. Is community water available? Is there natural gas available? How about high speed internet? If you have to drill a water is it feasible physically or financially? Is electrical service available? Can you get a permit for a septic system?

• Governmental Restrictions. Is it use restricted? Can it be subdivided? What improvements will be allowed? Is there an agriculture or wildlife exemption available?

• Improvements. What is the condition of the improvements? Do they contribute any value? What will it cost to make them useable? Are the buildings special purpose? Is there enough land for additional buildings? A five or ten acre site can be overwhelmed quickly by improvements. Are the fences and gates in good condition?

Summary

Value is foundational to the analysis of any decision making related to rural property. Since appraisal is the methodology used to estimate value, it is useful to have a basic understanding of the concepts involved. Market value is the most often used with financing, litigation and probate. Typically market value is conveyed in a formal written appraisal report issued by a certified appraiser. There are professional appraisal designations and specializations which require additional education and experience beyond the state certification requirements. The individuals who have earned these prestigious designations represent the top tier of appraisal professionals.

Let us hear from you.

We very much would like your comments and questions related to the appraisal of rural properties. We have been involved in the appraisal of rural property most of our professional life. We look forward to visit with you about any aspect of appraising you are interested in.

CHECK IN WITH US

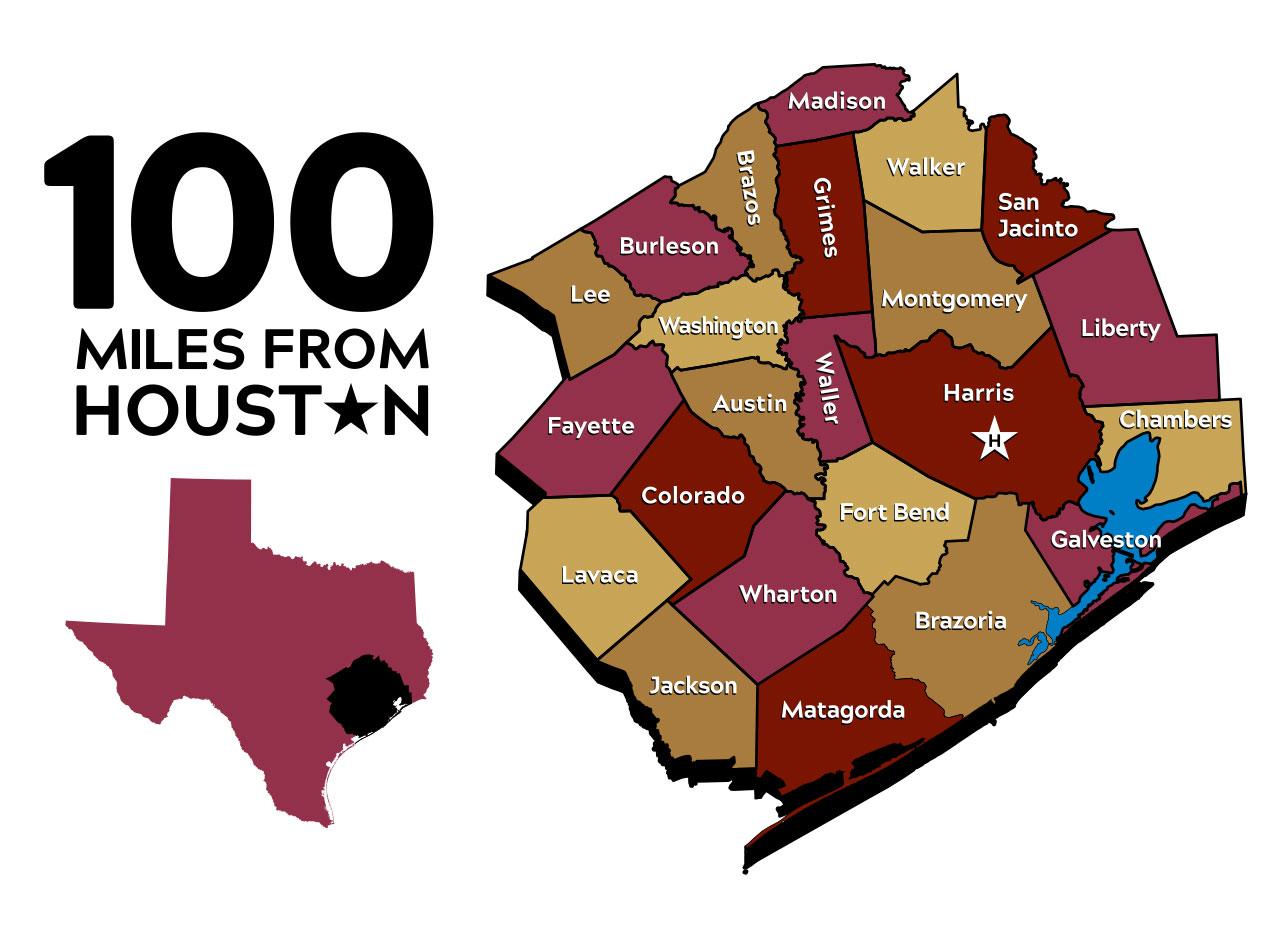

Allen Realty Advisors represents buyers and sellers of fine quality rural land near Houston. We specialize in weekend retreats, country estates, farms and ranches, recreational property and investment land. Our market area is generally within 100 miles (two hours) of Houston.

We are members of the RLI

We support the 4H and FFA

You might enjoy some of the following blog posts:

Easements Across Rural Land Near Houston

Texas History and Land Intertwined: 20 Books

Impact of Rights of Way Across Rural Land Near Houston

Choosing a Land Broker For Rural Land Near Houston

What is a Land Survey and When Do You Need One?

15 Common Questions About The Hemp Industry

Future Farmers of America: Pathway To Success

50 Great Time Saving Resources For Rural Land Near Houston

Country Fairs within 100 Miles of Houston

Country Lifestyles within 100 Miles of Houston

20 Questions (At Least) You Should Answer Before Buying (Or Selling) Rural Land Near Houston

Why Your Texas Broker Should Be A Member of the Realtors Land Institute

Financing Rural Land Near Houston

Why You Need a Buyers Representative When Buying Rural Land Near Houston

Road Trips within 100 Miles of Houston

Great Barbecue Joints within 100 Miles of Houston

100 Miles From Houston: Rural Land Near Houston

Ag Exemptions, Wildlife Exemptions, and Rollback Taxes for Rural Land Near Houston

From Contract to Closing

Appraising Rural Land Near Houston

Checklist for Selling Rural Land Near Houston

Checklist for Buying Rural Land Near Houston

Things to Consider Before Buying Rural Land Near Houston

THANKS FOR SHARING OUR POSTS